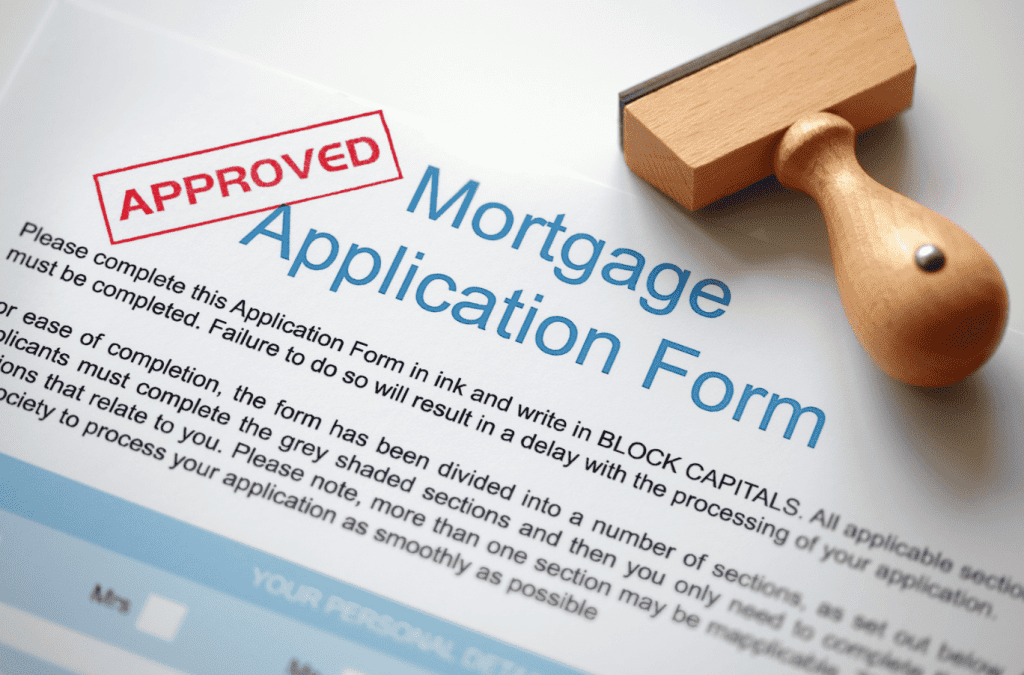

Helping Contractors Get The Best Mortgage Possible

Contractor Mortgages

Jones and Young are contractor mortgage specialists with over ten years of industry experience

As Seen In

CIS

Sub-Contractors

Why not request a call back and speak to our team today

REQUEST A CALLBACKContractors/ Freelancers

Why not request a call back and speak to our team today

REQUEST A CALLBACKUmbrella Contractors

Why not request a call back and speak to our team today

REQUEST A CALLBACKDay One Contractors

Why not request a call back and speak to our team today

REQUEST A CALLBACK

Welcome To Jones & Young Mortgages

Professional mortgage advisers with years of experience helping contractors get the mortgage they deserve without increasing their taxable income to get the mortgage they want. To calculate your contractor income, lenders use the formula:

Gross Day Rate x days in week worked x 46 or 48 weeks = annual income lenders will use. Some lenders use 46 weeks and others 48 weeks to calculate the annual income.

View our contractor mortgage calculator.

As specialist brokers and contractor specialists, we’ll find you the most competitive mortgage deal and present your income to a contractor mortgage lender in the right way. Our high-street lenders can use your retained profits, net profits or gross day rates. Instead of the average two years of company accounts, we only need 1 to 3 months of contractor experience. This is significantly less than the 12 to 24 months most self-employed people are required to provide. Our contractors are treated differently during the application process as we use your contract as income proof, rather than your self-assessment tax return or limited company accounts.

At Jones and young, we’ve secured hundreds of mortgages for contractors over the past few years and offer a whole of market approach. Not only does this ensure that they’re able to access the mortgage deals they need, but we can make this happen without delays and with consistently reliable outcomes.

Secured 100s Of Mortgages For Contractors

Gross Day Used For Affordability

Whole Of Market Access

Secure The Mortgage You Deserve

We have years of experience in helping contractors find excellent mortgages. Even if you’ve previously used another mortgage lender, we may offer a fresh perspective and find a better deal. Our experts will help assist with your mortgage application from the start to the end, all whilst offering helpful advice wherever needed. All interest rates are competitive, mainly from high street banks and building societies.

Building You A Brighter Future

Jones and Young act as the bridge between customers and the mortgage companies that can help them. Many lenders only deal with brokers like us, meaning a wider choice of available options. He’ll help ensure that you meet the contractor mortgage criteria, complete the mortgage application correctly and get the best deal possible.

We can help limited company contractors or sole trader/self-employed contractors.

Our Reviews

Up To 95% Loan To Value (LTV)

Loan to Value(LTV) options typically up to 95%

Trusted Advice

Clear and concise advice about the best options for your needs.

Communication

Helping customers cut through the noise to understand things their way.

Save Money

The difference between how your income is calculated can save you thousands.

Specialist Rates From Mortgage Market

Most competitive rates ensure the best price for customers

Helping Customers Secure The Homes They Deserve

A contractor mortgage can be confusing at the best of times. With various different ways to prove your income, even some mortgage lenders can find it confusing. Our role is to deliver fast, clear and straightforward advice about the best options for your goals and personal circumstances.

If you’re looking to buy your first home, home mover mortgages, secure a re-mortgage, or raise money for home improvements or debt consolidation, we can help. With decades of industry experience, you can be sure we’ll help secure some of the most competitive contractor mortgages.

- Industry-leading advice

- High Street Lenders

- Clear & straightforward recommendations

WANT TO TALK TO ONE OF OUR MORTGAGE EXPERTS?

Helping professional contractors, freelancers, and CIS subcontractors navigate the mortgage process and get the best possible deal by arranging mortgages using your annualised contract rate.

Mortgages For Contractors: Everything You Need To Know

When it comes to mortgages, navigating the process can be overwhelming for anyone. However as a contractor it may feel like deciphering a different language

Contractor Mortgages FAQs:

We’ve done our best to try and answer some of the most frequently asked questions about contractor mortgages below:

What is a contractor's mortgage?

This type of mortgage is secured based on your gross contract day rate, not your accounts. Find out more information with our helpful guide: Mortgages For Contractors: Everything You Need To Know

Is it possible to get a mortgage as a contractor?

Yes, it’s definitely possible to get a mortgage as a contractor! Here at Jones and Young, we specialise in getting contractors the mortgages they desire. If you’re interested in mortgage advice, please contact one of our mortgage professionals.

Can I get a mortgage on a freelance contract?

Yes, it is possible. You will usually require a minimum of 1 to 3 months completed on your first contract. In addition to this, your mortgage lenders may require other paperwork, such as identification and credit score.

Can I get a mortgage with a 6-month work contract?

Yes, as a contractor, the normal rules of self-employment don’t count. As the lender uses the contract as income proof, you do not need the normal 12 to 24 months self-employed trading history. You will need two years of industry experience in the same line of work.

Your Trusted Team Of Experts

GET IN TOUCH